|

10.23 Query Bank Reconciliation

KB 3235, Release Note, Bank Reconciliation, 10/22/2025

Transform your month-end close with new Bank Reconciliation tools in Version 10.23!

Version 10.23 introduces powerful new Bank Reconciliation capabilities that give your Dealership greater control, efficiency, and independence in managing banking processes - without delays or support dependencies.

Key Enhancements:

-

Flexible Adjustments: Edit statement dates, reverse committed reconciliations, and restore previous reconciliations - while preserving all cleared transactions.

-

Non-Disruptive Access: Review reconciliations without entering the Bank Account screen, preventing data locks that could interfere with concurrent processes like cheque runs.

-

Complete Oversight: Benefit from detailed audit trails, seamless Bank Account integration, and versatile export options for total visibility and compliance.

These enhancements accelerate your month-end close, reduce operational bottlenecks, and ensure smooth, accurate financial operations.

Setups

User Permissions

The following existing system permissions are required to use the features described below. Users must have Reconcile Accounts access to view Query Bank Reconciliation.

To set up User permissions, navigate to,

Employee > User Maintenance > Select User Record > Accounting Security Tab

How To Use

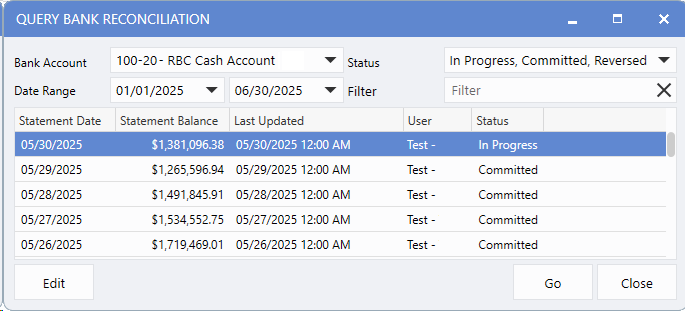

Accessing Query Bank Reconciliation

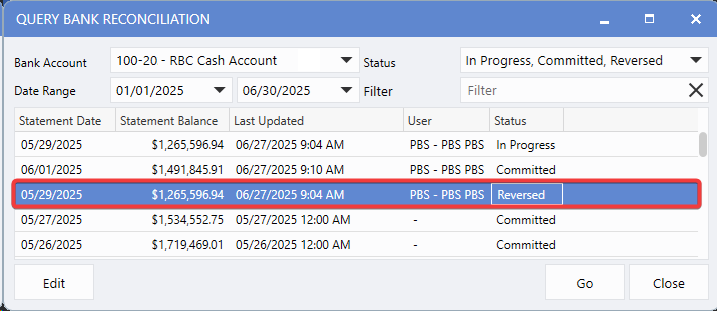

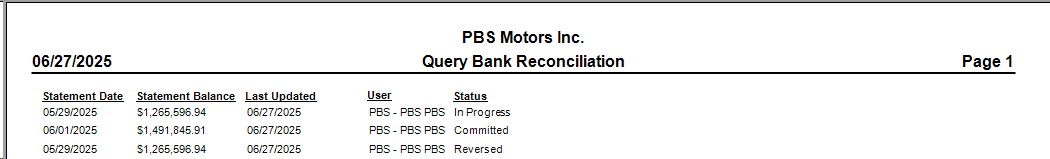

The Query Bank Reconciliation window offers a centralized view all Bank Reconciliations for any bank account within a selected date range, functioning much like other query screens in the system.

To view this window, follow the path:

Accounting > Bank Manager > Query Bank Reconciliation

1.

Open

Query Bank Reconciliation.

2.

Select the

Bank Account

you want to review.

3.

Set your desired

Date Range

.

4.

Apply the

Status

filter to include In Progress, Committed, or Reversed Reconciliations.

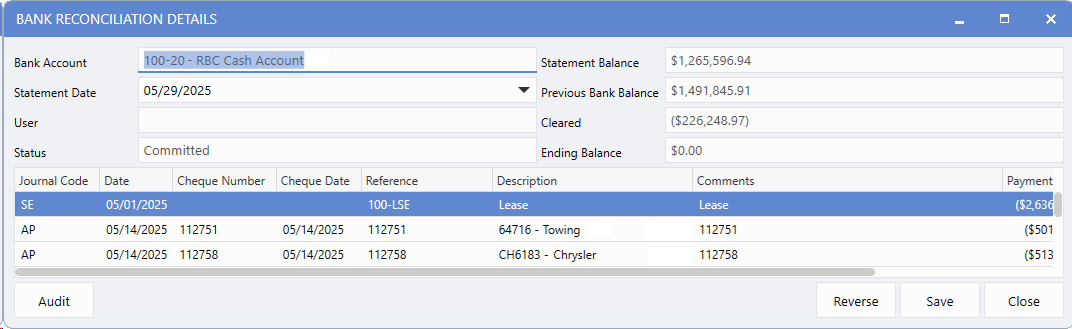

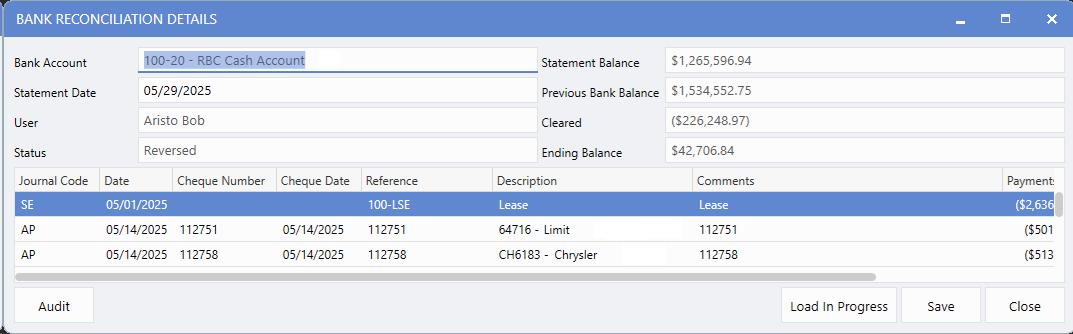

Viewing Bank Reconciliation Details

The Bank Reconciliation Details window provides a complete, read-only view of a specific reconciliation, including all cleared transactions, statement details, and reconciliation status. This allows Users to quickly review historical reconciliation data without making changes.

Accessing Details:

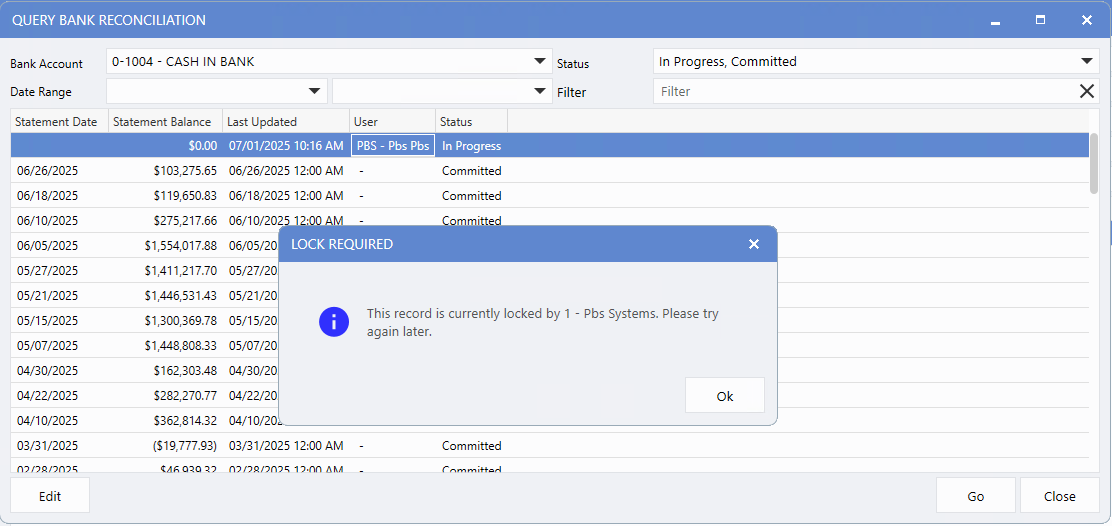

Behaviour by Reconciliation Status:

Note:

If another User is actively reconciling the same bank account in Reconcile Account, a data lock message will appear.

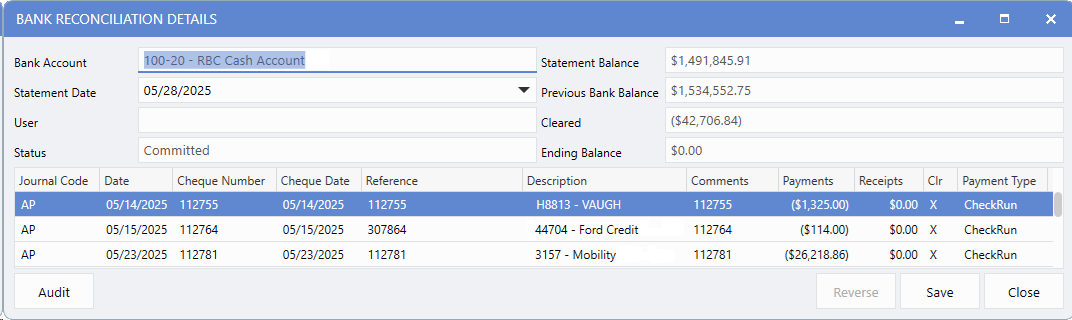

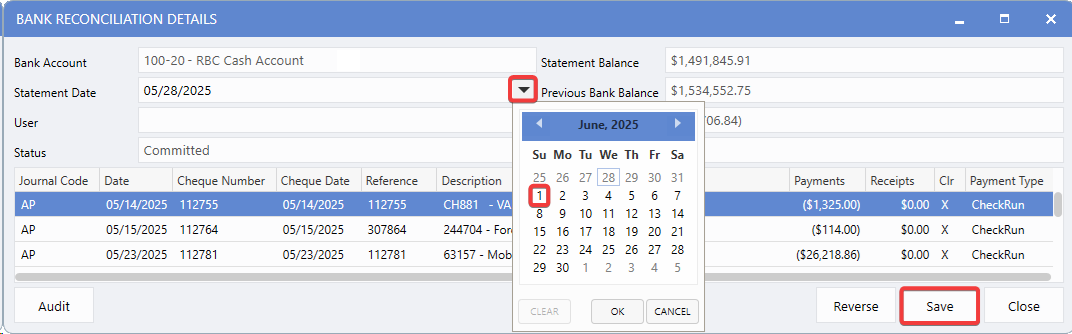

Editing Statement Dates

Users can now update statement dates directly from the Bank Reconciliation Details window when errors are identified after a reconciliation is completed. This removes the need to contact support for date corrections during month-end processing.

To edit a statement date:

1.

In Bank Reconciliation, open the Bank Reconciliation details window for a

Committed

reconciliation.

2.

Click in the

Statement Date

field to enable editing.

3.

Enter the corrected

Statement Date

.

4.

Click

Save

to apply the change.

5.

The system will

validate

that the new date does not overlap with existing reconciliation dates.

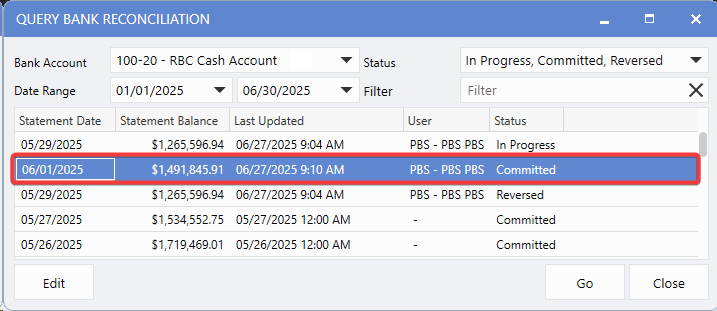

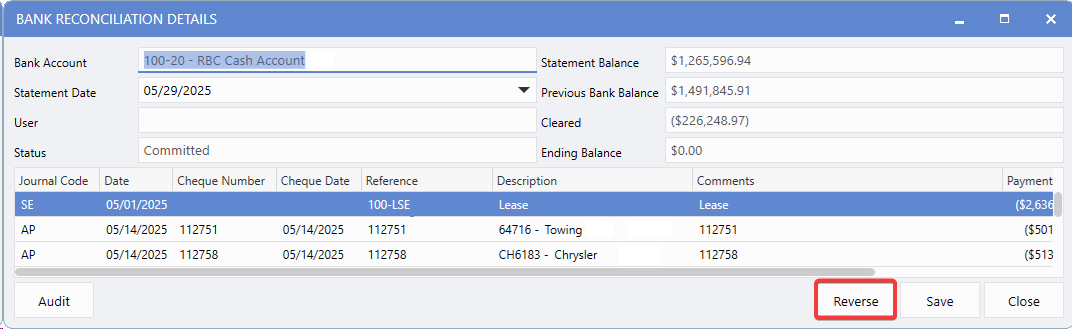

Reversing Bank Reconciliations

The reverse function enables Users to undo a Committed Bank Reconciliation when an error is discovered. to protect data integrity, this feature is limited to the

most recent reconciliation

and eliminates the need for support assistance.

To reverse a reconciliation:

1.

Open the Bank Reconciliation Details window for the

most recent Committed

reconciliation.

2.

Click

Reverse

.

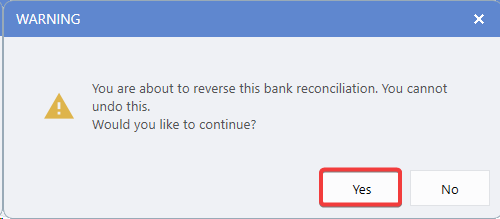

3.

Review the

Warning Message

noting that the action cannot be undone.

4.

Click

Yes

to confirm.

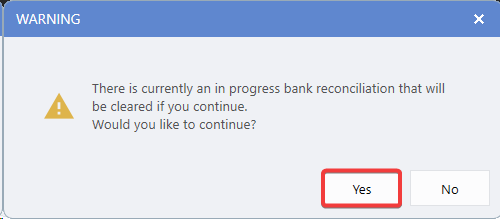

Note

If an In-Progress Bank Reconciliation exists, you will see a warning message that it will be replaced. The existing reconciliation will be cleared and overwritten.

5.

The reconciliation status will update to

Reversed

, and the transactions will be available for re-reconciliation.

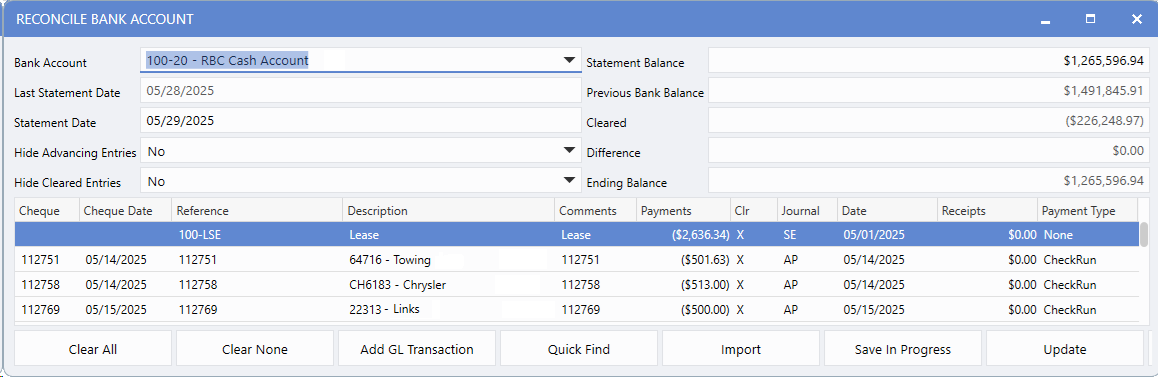

Loading Reversed Reconciliations

After reversing a reconciliation, Users can restore it to In-Progress status with all previously cleared transactions preserved. This eliminates the need to re-select the same transactions that were already reconciled correctly, saving time and reducing errors.

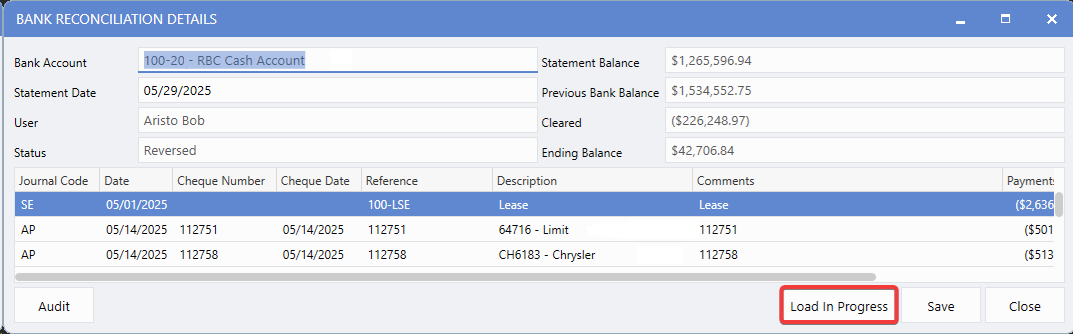

To restore a reversed reconciliation:

1.

Open the Bank Reconciliation Details window for a

Reversed

reconciliation.

2.

Click

Load In Progress

.

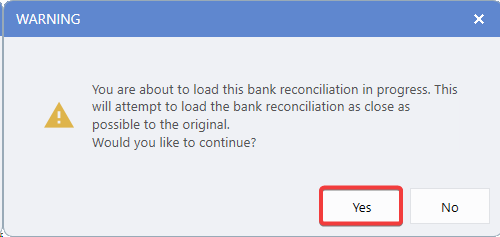

3.

Review the

Warning Message

about replacing any existing In-Progress reconciliation.

4.

Click

Yes

to proceed.

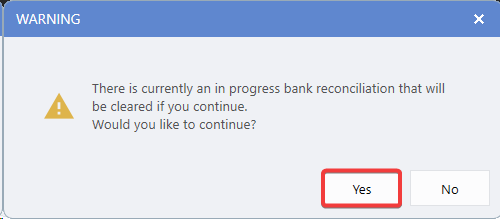

Note

If an In-Progress Bank Reconciliation already exists, a warning message will appear. The current in-progress reconciliation will be cleared and replaced.

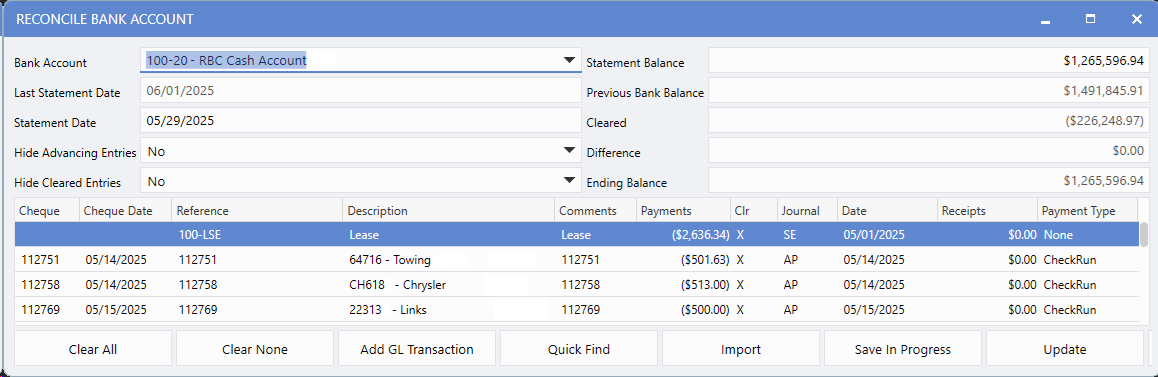

5.

The system restores the reconciliation with the same cleared transactions and updates the statement amount and date from the reversed reconciliation.

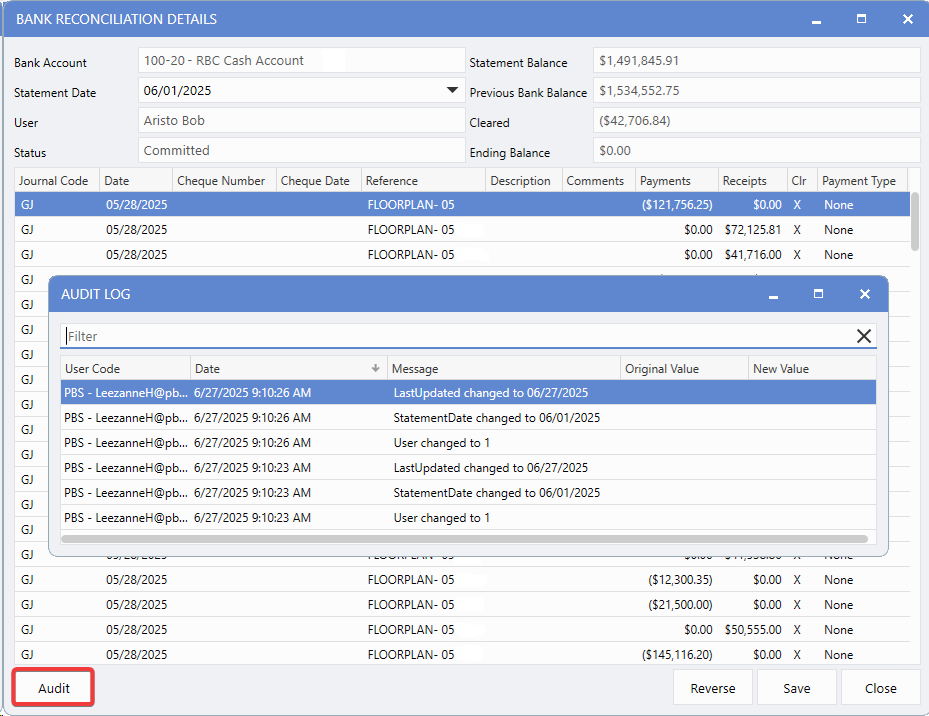

Viewing Audit Information

Enhanced audit trails record all changes to Bank Reconciliations - including date edits and status update - ensuring complete accountability and traceability of reconciliation activity.

From the Bank Reconciliation Details window, click the

Audit

to view a detailed history of changes. Audit data is available for both Active and Reversed Reconciliations.

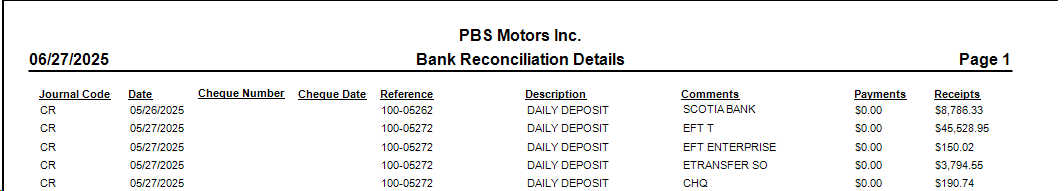

Data Export

The export feature lets Users extract reconciliation and transaction data for external reporting or analysis, following the same format and functionality as other query screens in the system.

To access export options,

Right-Click

within the Query Bank Reconciliation or Bank Reconciliation Details grid and choose

Export

.

Query Bank Reconciliation

Bank Reconciliation Details

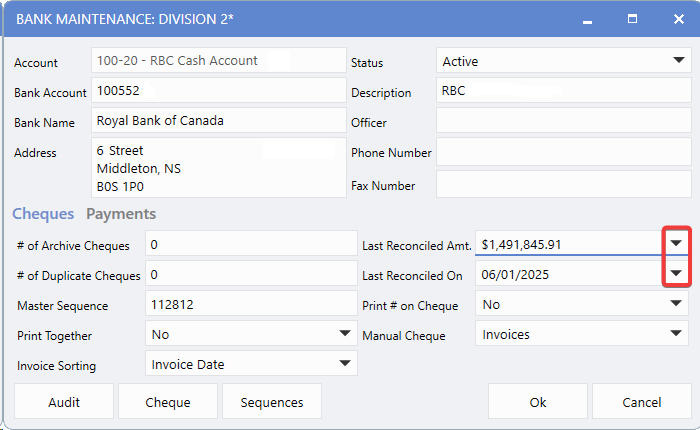

Bank Account Maintenance Changes

The Bank Maintenance window now features automated reconciliation tracking with two key fields:

Last Reconciled Amount

and

Last Reconciled On

. These fields automatically update with data from the most recent committed reconciliation, eliminating manual entry and reducing the risk of errors.

To view these changes, navigate to:

Accounting > Bank Manager > Bank Maintenance > Bank Account

Setting Up New Bank Accounts

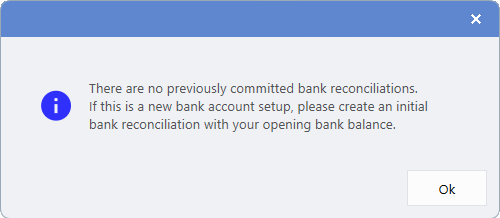

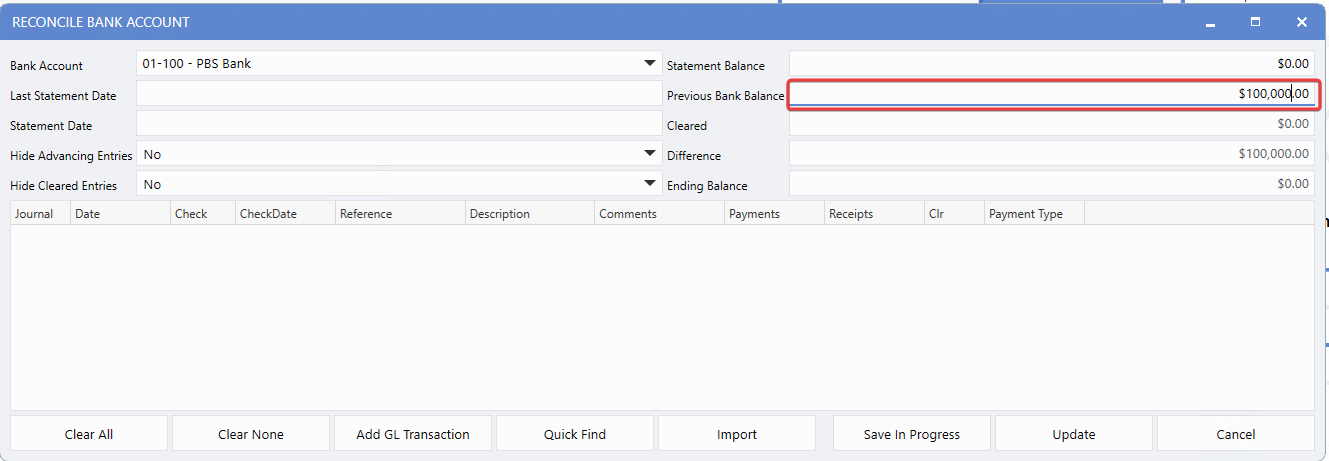

For new Bank Accounts with no committed reconciliation history, the Last Reconciled Amount and Last Reconciled On fields will be blank. If Users attempt to click the drop-down buttons next to these fields, a warning will indicate that no reconciliation data is available.

To establish the initial bank balance, Users can free-type the amount in the Previous Bank Balance field during the first reconciliation process. This sets the baseline for all future reconciliations.

|